Professional Fee-Only Investment Planning Service

A Strategic Approach to Growing Your Portfolio

At Impact Wealth Management, we understand that your financial journey is as individual as you are. Based in Sioux Falls and Phoenix, our priority is to provide a roadmap tailored to your personal goals and financial objectives. We use a fee-only structure that gives you confidence that our advice is delivered with a commitment to fairness and transparency. We take our fiduciary duty seriously. We believe that charging a flat fee is the best way to align our success with your family's well-being.

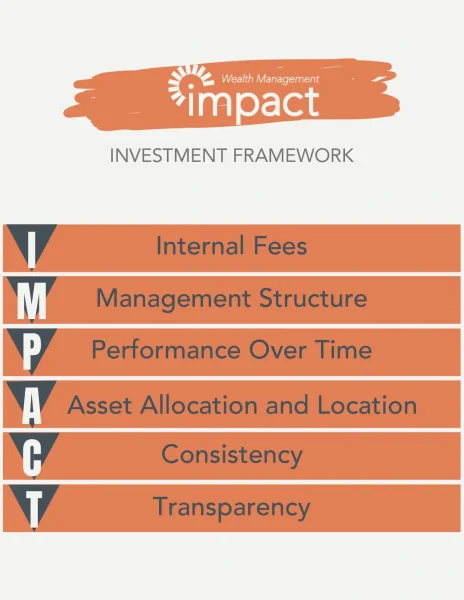

We take a comprehensive approach to managing your investments, developing a strategic plan that keeps your long-term goals in focus. With the use of our IMPACT Framework, we design investment portfolios that focus on diversification using low-cost investments. This disciplined strategy is a reflection of our dedication to listen and respond to your needs, cultivating an investment plan that turns dreams into achievable financial goals.

We recognize that effective wealth management encompasses far more than asset allocation. Our comprehensive plans address all aspects of your financial life. From estate planning and tax strategies to asset management and wealth preservation, our team provides consistent support. When you choose Impact Wealth Management, you are entering into a relationship that serves your interests first, forges a path toward financial freedom, and creates an enduring legacy that resonates with the impact you wish to have on the world.

Investment Planning Service

In Sioux Falls and Phoenix, we at Impact Wealth take pride in our tailored investment planning services that ensure all aspects of your wealth are proactively managed for today and the future.

Investment Planning

In Sioux Falls and Phoenix, we at Impact Wealth take pride in our tailored investment planning services that ensure all aspects of your wealth are proactively managed for today and the future.

Holistic Wealth Management

Our team takes a holistic view, considering every element of your financial life, from tax optimization to retirement planning. We believe in creating a transparent and consistent strategy that not only encompasses investment planning but also aims to give your wealth a purposeful impact.

Fee-Only Structure

Operating as fee-only financial advisors, we have a cost-effective, transparent flat fee structure. Without hidden commissions, our focus remains on what's best for your financial success. We work hard to align your financial portfolio to a customized path to achieving long-term goals so that every dollar you invest is managed with your best interest in mind.

Fiduciary Commitment

As your dedicated advisors, we take our fiduciary duty seriously. This commitment mandates that your best interests are always at the forefront of our decisions. We forgo commission-based incentives, advocating instead for a transparent and fair flat-fee relationship where our guidance is dictated solely by your needs and financial well-being.

Our Investment Planning Philosophy

Internal Fees

Investments carry costs. Many of these costs are hidden from investors by confusing jargon and fine print. At Impact Wealth Management, we recognize that fees (even the ones you can’t see) affect the performance of your portfolio. We believe in using prudent, low-cost investments.

Management Structure

Though our preference is low-cost investment portfolios, on the occasion that a mutual fund is used, Impact Wealth Management’s Investment Board looks closely at the structure of the mutual fund’s management team. We research not only the performance of the fund, but the management team that oversees the fund. We ask the deeper questions like “How long has the management team been in place at this fund?” and “is this fund actively managed or passively managed?” Understanding the structure of an investment management team gives us deeper insight on what we can expect from the fund going forward.

Performance Over Time

The last 10 years probably won’t look the same as the next 10 years, so there should be more to choosing investments than reviewing the investment’s historical track record. When choosing investments for our portfolios, our team looks not just at the recent historical performance, but also how the investment has performed during different market cycles (like the 2008 financial crisis and rising and falling interest rate cycles).

Asset Allocation/Diversification

We do not believe in timing the market. We believe that the biggest factor in how your portfolio performs over time is how it is allocated and how well you stick to the strategy. We work hard to understand your risk tolerance, your need for risk, and your ability to take risks. This understanding helps ensure that our clients have an appropriately diversified allocation for their financial goals. Where you own these assets is also important. For instance, your tax-free accounts should not hold the most conservative assets in your portfolio.

Consistency

Consistency matters. While some advisors invest your money with no plan for monitoring your portfolio, Impact Wealth Management’s Investment Board meets consistently every quarter to review our client’s holdings and the ever-changing economic conditions. While no one knows what the future holds, you won’t find us asleep at the wheel. We consistently monitor your portfolio and keep you informed through regular communication.

Transparency

Our investment approach is straightforward and transparent. Our firm does not receive hidden commissions or back-door compensation from any of the investments we make. Because of this transparency, you can feel assured that the investments we choose are not motivated by self-interest, but rather the deep desire to align your portfolio with your family’s goals.

Investment Planning Process

Our mission at Impact Wealth is to offer a personalized investment planning process. This method gives you the assurance that your plan isn't one and done. We work closely with you through every step of our process.

Assess Financial Situation

First, we evaluate your current financial situation, considering all assets. This includes reviewing cash, investments, retirement accounts, and other financial holdings to completely understand your financial situation.

Understand Client Needs

We dedicate time to understand your unique needs and wants. Your financial journey is as unique as your fingerprints. Our advisors listen carefully to what truly matters to you so that you feel seen, heard, and understood.

Set Financial Goals

Together we establish specific, measurable financial goals. Whether it's planning for a comfortable retirement or creating a legacy, we help articulate these objectives to ensure they're aligned with the way that you want to live your life.

Analyze Gaps

Our gap analysis identifies disparities between your current financial situation and your long-term goals. We scrutinize financial projections and potential risks so that we can plan to bridge these gaps effectively.

Create a Custom Investment Plan

Utilizing our IMPACT Framework, we craft a custom investment plan suited to your risk tolerance and financial targets.

Build an Investment Portfolio

We construct a diversified investment portfolio, integrating strategic asset allocation with your risk profile and the goals set forth previously.

Monitor and Manage

We consistently monitor your investment portfolio's performance, considering the dynamic nature of markets and changes in your life. We meet regularly with you to review these changes and make sure that your financial plan stays aligned with your life.