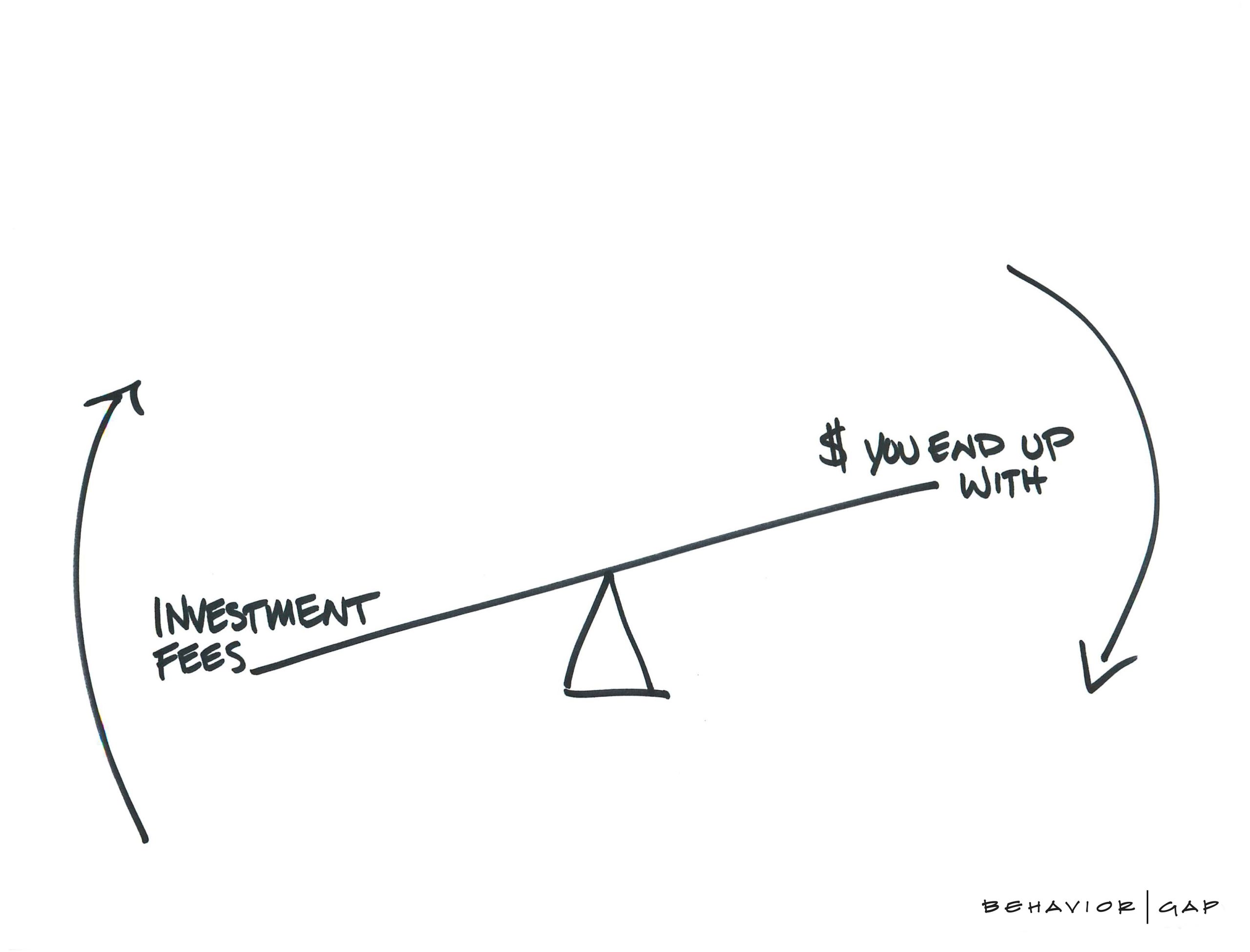

As a savvy investor, you need to understand what fees you are paying your advisor and exactly what you’re receiving for that fee to avoid overpaying. But it can be extremely difficult to “decode” your investment fees.

Types of Investment Management Fees

Commission based advisors are almost a thing of the past so most financial advisors charge a percentage of your overall portfolio. Some advisors provide only investment management for that fee while others provide more comprehensive financial planning at no additional cost. Still other financial advisors charge a fee for asset management (1% is typical) PLUS a planning fee.

In recent years some additional alternatives to the traditional 1% asset management fee have emerged.

You need to understand what other options are available to you!

To make an informed decision, ask your financial advisor to explain the fees that they are charging and make sure to convert any percentages to DOLLARS AND CENTS.

(Scroll to find the category that best defines your own personal portfolio)

IF YOUR PORTFOLIO IS LESS THAN $400,000

Since asset management fees are often graduated, it is possible that you are paying more than the typical 1%… even up to 2% of your portfolio value.

If your financial advisor is doing more than just investing your money (like helping you with retirement projections and such) then a percentage fee could be appropriate for you.

Ask your advisor to convert the percentage into dollars and cents so that you understand completely how much their services are costing you.

ALTERNATIVES TO AN ASSET MANAGEMENT FEE (Portfolios <$400k):

If all you’re receiving from your financial advisor is investment help, then an “advice-only” financial advisor and a robo investment manager could be a more appropriate and cost-effective solution for you.

Advice-only advisors do not actually manage your money directly, but they can give you some direction. An advice-only advisor can give you help with planning – for instance, deciding how much and in what type of account you should be investing in – for an agreed upon fee. A robo investment advisor is a low-cost way to put your advice-only advisor’s suggestions to work.

The closer your portfolio gets to $400,000 the less attractive an asset management fee becomes.

IF YOUR PORTFOLIO IS BETWEEN $400,000-750,000

Since asset management fees are often graduated, it is possible that you are paying more than the typical 1%… a fee up to 1.5% is common for portfolios under $1M.

For the fee that you’re paying (between $4,000 and upwards of $10,000 a year) you should definitely be receiving more than just asset management and you shouldn’t be paying any separate planning fees either.

Your advisor should be providing regular reviews (at least annually) and discussing things like taxes, retirement planning, estate planning considerations, etc.

If your advisor isn’t providing those services, you should look for another advisor. There are many great financial advisors out there that WOULD provide these services for a similar fee – maybe even lower!

ALTERNATIVES TO AN ASSET MANAGEMENT FEE (Portfolios $400k-$750k):

For portfolios in this range, a flat fee advisor that provides comprehensive financial advice and investment management could be a great option for you.

Comprehensive flat fee advisors charge a set flat rate for planning AND investment management. Fees can vary from one advisor to the next depending on the advisor’s experience and the services that they provide.

With a portfolio between $400k-$750k, a flat fee advisor might not reduce the overall fee that you’re paying, but they can provide you with a predictable and fixed rate. One of the main advantages to working with a flat fee advisor is that you know exactly what you’re paying each quarter since the fee does not vary with the value of your portfolio.

A flat fee advisor has fewer conflicts of interest than an advisor who charges a percentage of your overall portfolio. For instance, an advisor charging a percentage is paid less when you take money out of your portfolio so they may be less inclined to advise you that it’s ok to increase your withdrawal or make a large purchase. It is also to their detriment to allocate your portfolio more conservatively since that likely makes your portfolio grow more slowly.

For people approaching retirement these are conflicts of interest that you definitely want to avoid.

IF YOUR PORTFOLIO IS OVER $750,000

For portfolios over $750,000, asset management fees start to add up fast. Advisor fee schedules are often graduated. If your portfolio is less than $1,000,000 you are likely to pay somewhere between 1.25% and 1%. When the total of your portfolio exceeds $1,000,000 the percentage may decrease to less than 1%.

A fee that is less than 1% seems good, right? Maybe – but this is why it’s extremely important to convert that fee to dollars and cents. A $2,000,000 portfolio paying .8% equates to a reoccurring fee of $16,000 a year – and as the market increases, so does your fee. Ten years from now you could be paying DOUBLE.

After 17 years of experience in the industry, it is our opinion that there is little that an advisor can do consistently to justify a fee that exceeds $10,000 a year.

Does the complexity of my portfolio increase with the SIZE of my portfolio?

Contrary to popular belief, the complexity of a portfolio is not necessarily related to the SIZE of a portfolio.

Unless your situation is very complex, when your fee exceeds $10,000 a year you are likely essentially subsidizing accounts that your advisor has taken on that aren’t as profitable to their practice.

At this level, your advisory fee is likely one of your largest personal expenses. Your advisor should be providing you with planning in all areas of your financial life… from retirement projections to tax planning, end of life and estate planning. You should feel completely confident that they are looking at all aspects of your financial situation. They should be listening to you, asking questions, strategizing plans and collaborating with your other financial professionals (like your attorney and your accountant when necessary).

You should meet with your financial advisor at least twice a year.

If your fee exceeds $10,000 a year, you may be able to negotiate a lower fee with your advisor.

ALTERNATIVES TO AN ASSET MANAGEMENT FEE (Portfolios $750k +):

In this situation, a comprehensive flat fee financial advisor could save your family thousands of dollars each year.

Comprehensive flat fee advisors charge a set flat rate for planning AND investment management. Fees can vary from one advisor to the next depending on the advisor’s experience and the services that they provide, but rarely exceed $10,000 a year.

At Impact Wealth Management we charge a flat $8500 for our comprehensive planning package.

A flat fee advisor has fewer conflicts of interest than an advisor who charges a percentage of your overall portfolio. For instance, an advisor charging a percentage is paid less when you take money out of your portfolio so they may be less inclined to advise you that it’s ok to increase your withdrawal or make a large purchase. It is also to their detriment to allocate your portfolio more conservatively since that likely makes your portfolio grow more slowly.

For people approaching retirement these are conflicts of interest that you definitely want to avoid.

Choosing a financial advisor is hard. Figuring out how and how much you’re paying them shouldn’t be.

In the last few years there’s been an increasing cry for “fee transparency”. We believe that eventually the practice of charging based on a client’s total portfolio value will be a thing of the past. Until then, we hope this blog will help you decode the fees that you’re paying, help you avoid OVERPAYING for the services you’re receiving and educate you on the alternatives.

If you still have questions, we’d love to help! Give us a call!

Impact Wealth Management is a registered investment advisor in beautiful Sioux Falls, SD. Impact Wealth Management is regulated by the State of South Dakota. The commentary in this blog reflects the personal opinions, viewpoints and analyses of Impact Wealth Management and its employees. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website should be considered investment, tax or legal advice.