One of the benefits of being a financial advisor is that you never have to shop for a financial advisor! But it does also uniquely position us to help you choose the right financial advisor!

Why is it so hard to find a good financial advisor?

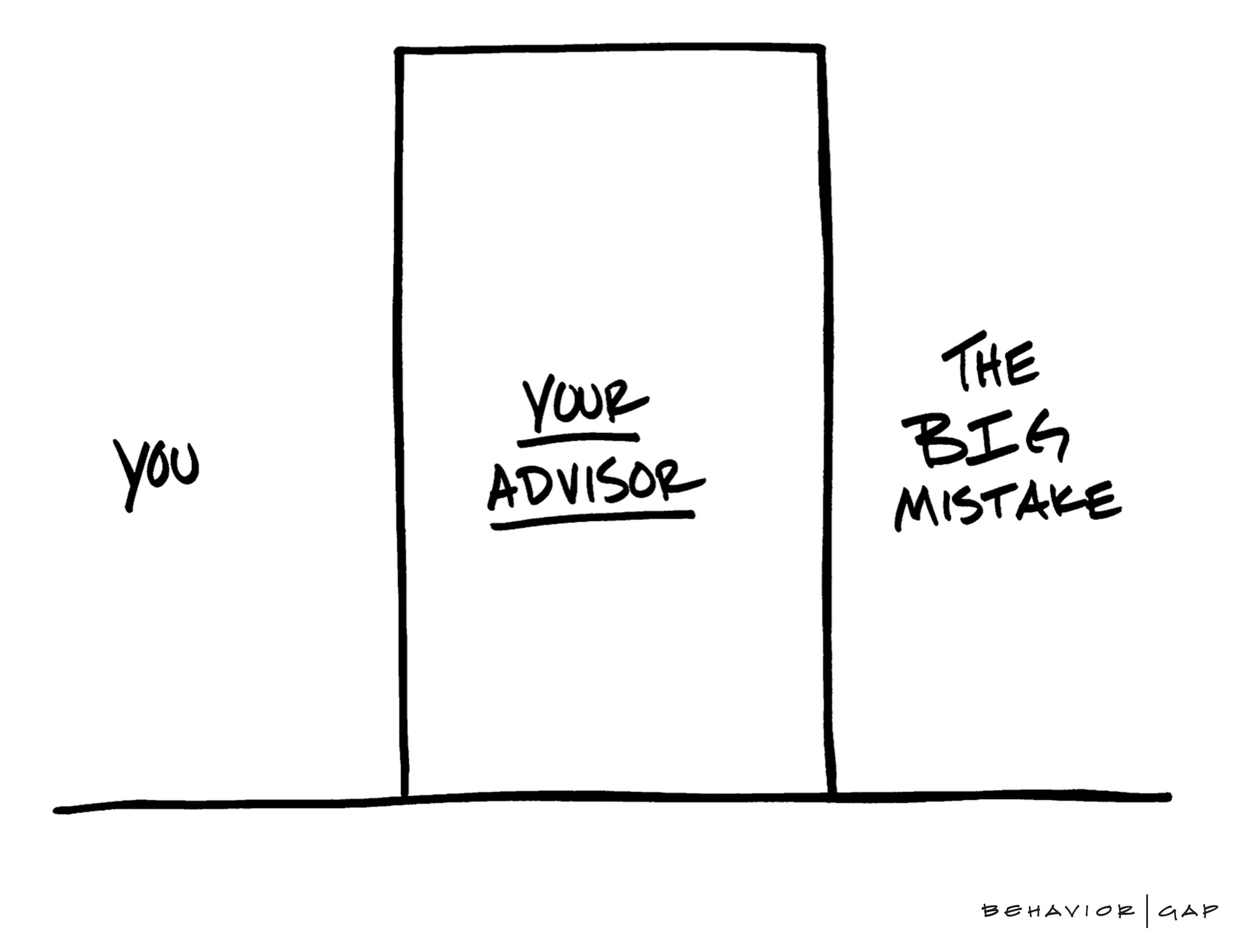

The financial industry has some fundamental flaws that make choosing a financial advisor an unnecessarily hard task. It seems that the industry as a whole loves to make things as confusing as possible with acronyms, hidden fees, and very nuanced language (like fee based vs fee only – there’s a difference!).

As a consumer it can be really hard to figure out the answers to what SHOULD be basic questions like “How much does it really cost to work with you?” or “Are you qualified to manage my hard earned money?” Sadly, sometimes you have to know how to word your questions in order to get a straightforward answer and sometimes you need someone to decode the answers for you.

At Impact we value transparency and authenticity and we want to help you craft good questions so that you can make an informed decision about who to trust with your family’s legacy. We also want to help you decode some of the “financial advisor speak” that you might get when you ask these questions.

When you’ve found yourself at the point where you need to hire a financial advisor (or you don’t like the one you’ve got so you’re looking for a new one), here is a guide to finding a good financial advisor.

PHASE 1: CHOOSING WHICH FINANCIAL ADVISORS TO MEET WITH

STEP ONE: Gather names.

You could google financial advisors in your area. That will likely bring up a LOT of “Ads”. That just means that those people paid to have their name appear at the top of a search… which might not be bad, but it certainly doesn’t mean they’re good advisors.

If you keep scrolling past the ads you will likely find a lot of websites who claim to have a list of the best financial advisors in the area. Keep scrolling. Nearly all of these lists are garbage. Most of the time the advisors on the lists have paid for some kind of membership with the company who’s posting the results.

Google just isn’t the best way to find a good financial advisor.

One of the best ways we’ve found to get a good lead on a financial advisor is to ask your friends who they are working with. Studies show that over half of the investors out there found their current advisor through a friend.

STEP TWO: Check them out!

Once you have a few names collected from a handful of trusted friends, NOW you can use google.

Visit the advisors websites. Sure, you could argue that this might be a little bit like judging a book by it’s cover, but you can learn a lot by visiting a website.

First of all, if the advisor doesn’t have a well maintained website I would be concerned that this means they are not keeping up with the world as it evolves. A website has been considered a business fundamental for at least a decade. In financial planning, keeping up with ever changing business trends and communicating that information to our clients is absolutely critical.

Second, read the content of the website. Do you understand it? Does it seem personal or does it appear really high level using flowery words that sound nice but don’t really help you understand anything? The way that the advisor communicates on the website is going to be a clue about how they will communicate with you if you become a client.

PHASE 2:INTERVIEWING FINANCIAL ADVISORS

STEP ONE: It’s time for a self pep talk.

Cue the Rocky music, look in the mirror and repeat after me:

- I am awesome.

- I am smart.

- I have worked hard.

- Even though I have failed, I have succeeded.

- I am more than the figures on my balance sheet.

- I will not let anyone puff me up or make me feel less than because of those numbers.

- I will ask questions and I will not be afraid to say “I don’t understand”. I WILL find the right advisor for my family!

STEP TWO: YOU ask the questions.

In an introductory meeting financial advisors usually ask YOU a lot of questions. We think you should flip the script here. After all, you’re the one doing the interviewing.

Financial advisors typically have a system and a “pitch” that they like to give clients, this sets up the power dynamic so-to-speak. They ask the questions, they control the meeting.

Let the financial advisor know that before you disclose all of your personal financial information to them you would like to ask THEM some questions. When you do this you subtly shift the power in the meeting. This should help you get more authentic answers from the advisor since they won’t be playing back the same meeting agenda they’ve rehearsed time and time again.

STEP THREE: Determine if they share the same core beliefs and values that you do.

Don’t be afraid to ask hard questions! It might sound hard to believe but your relationship with your financial advisor will be one of the most personal relationships you will have. Finances touch everything. Your financial advisor is one of the first people you call when you have happy news (We’re having a baby! We’re retiring! We’re buying a car!) and one of the first people you call when you have bad news (I just got laid off, I’m getting divorced, someone I love died). You will call on them to help you when the markets make you feel anxious and (since you’re going to do such a good job choosing your advisor) you will look to them for advice for the rest of your life.

The bottom line is that our beliefs drive our behavior. Feel free to ask them personal questions about their positions on anything that matters to you; yes, even politics!

STEP FOUR: Ask them about their financial planning process.

You might say something like “tell me about your financial planning process.”

Every advisor that’s worth their salt will have a basic process that will look something like this:

- Understand the client’s personal and financial circumstances

- Identify goals

- Analyze current course of action

- Develop and deliver recommendations

- Implement recommendations

- Monitor progress and update plan

If the advisor gives you this rote response without elaborating, ask them HOW. HOW do you understand my circumstances now? How will make sure you understand my changing circumstances? HOW will you monitor progress? etc.

If you’re not completely satisfied with the answer, this is a great place to use the simple phrase: “Tell me more.”

Take notes

STEP FIVE: Find out how many clients they personally work with.

The correct answer here is 200 or less. Some financial advisors look “successful” because they’ve taken on way too many clients. In order for a financial advisor to deliver truly personalized service, we believe they absolutely should not be working with more than 200 clients per advisor.

When an advisor gets more than 200 clients this typically means that the advisor will spend their days in appointments with no time to consider your portfolio unless you are sitting in front of them. They will build large teams of less qualified individuals who will ultimately be responsible for much of the work that you would expect your advisor to be doing.

STEP SIX: Find out how much they charge… in dollars and cents

A very large majority of today’s financial advisors charge according to how much money you have. Fees can vary according to account size, but 1% is a typical fee. At Impact we think that this is an incredibly antiquated way of doing business (read more about that here).

Price is what you pay, value is what you get. Make SURE you understand the price so that you can evaluate the value. If the advisor quotes you a percentage, ask them to convert that percentage to an actual annual number. One percent doesn’t sound like a lot, but you may be surprised by how much that actually converts to.

Make sure you understand if the financial advisor is FEE ONLY (which means they cannot accept any commissions) or FEE BASED (which means they may receive some commissions in addition to the fee they’re charging you).

If the interview has gone well up and to this point, but the advisor has a fee that you feel is too high, the good news is that you may be able to negotiate fees. We will post more about how to negotiate fees with your advisor in a separate blog.

STEP SEVEN: Ask yourself “How do I feel?”

You’ve gathered your data, but what is your gut telling you?

- Did you get a good feeling?

- Did you understand the things they were talking about?

- Did they talk down to you or avoid answering questions directly?

- Did you ENJOY your conversation?

- How did your spouse feel about the meeting?

Chances are you’ve been observing people your whole life. You’ve had lots of encounters with people you didn’t like and there are some people who just set you at ease. Listen to your gut.

Choosing a financial advisor is ideally a lifelong decision. You want to enjoy meeting with them, you want to be sure that they see you and understand you. You need to understand their advice and you need to be confident that they are giving you advice that’s in your best interest.

STEP EIGHT: Set follow up meetings for the contenders

Hopefully you found at least one advisor that you felt confident in. Set a follow-up meeting with that advisor and prepare to answer all of their questions.

Be honest. Make sure that you disclose everything they ask for – they need accurate and thorough information to put together a solid plan. If you don’t feel comfortable disclosing everything then chances are you are not confident that the advisor has your best interest at heart and you should go back to the drawing board.

Most advisors who are doing a thorough job will have one appointment to ask you questions about your situation and another appointment to deliver their recommendations. Be wary of an advisor who tries to cram it all into one meeting.

Choosing the right financial advisor for your family is a decision that can impact your family for generations. If you have any questions, we’re here to help… and we’d love to be considered for an interview!

You’ve got this!

Investing involves risk. As a general rule you should only trade in financial products that you are familiar with and understand the risks associated with them. Impact Wealth Management LLC is a fee-only Registered Investment Advisor (RIA). We are based in beautiful Sioux Falls, SD and regulated by the State of South Dakota. Throughout this site, we went out of our way to present unbiased data believed to be from reliable and respected sources. However, its accuracy, completeness, and relevance are not guaranteed, and no responsibility is assumed for errors or omissions.