I get it. The stock market can feel terrifying.

ESPECIALLY if you don’t feel confident in your financial advisor. Are they really working for YOU? Are they always making trades in your account, or never making trades in your account? Do you understand their answers when you ask them questions? If the source of your anxiety is your financial advisor, then this post won’t be as applicable. You should start interviewing other financial advisors.

If you feel confident that you are diversified and that your financial advisor is really working for you (and not just his/her next commission) then read on…

Emotions are Terrible Financial Advisors

Warren Buffet is often regarded as the most successful stock investor of our lifetime. When asked about his success in the stock market, he is quoted as saying:

“The stock market is a device to transfer money from the impatient to the patient.”

Warren Buffet

I’ve been a financial advisor for more than 15 years. I was licensed at the height of the market in 2007 so nearly all of my first three years as an advisor were spent in “The Great Recession” and the subsequent years spent in the greatest bull run in the history of the stock market. I have witnessed investors operating in all range of emotion and what I have concluded is this: Emotions are TERRIBLE financial advisors.

When the economy is humming along, I’ve seen investors become emboldened – thinking that they should borrow money against their houses just to get more into the stock market. I’ve seen employees who believe so much in their companies that they make unreasonable investments in their company stock – they have such strong FEELINGS that they can’t see what could go wrong. And when the stock market starts plummeting I’ve counseled many investors against cashing in their loses.

“Be greedy when others are fearful and be fearful when others are greedy.”

Warren Buffet

Our emotions advise us to do exactly the opposite. When everyone is being greedy and the markets are soaring, we have FOMO (fear of missing out). We can become irrationally motivated to invest more and increase our risk. When the markets start to falter we panic and want to cash in our investments for a loss.

Taking the Emotion out of Investing

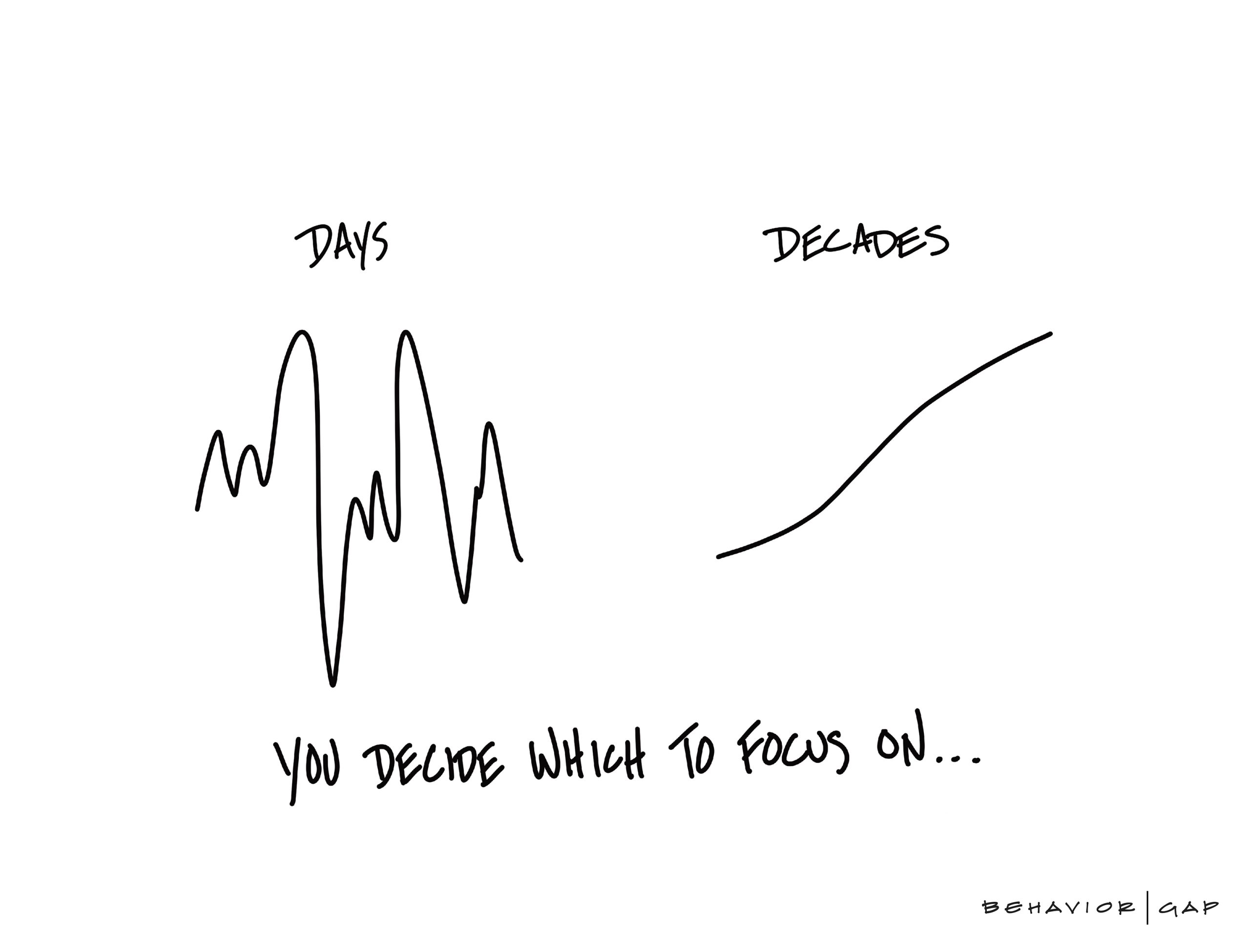

Why is it so hard to take emotion out of investing? Perhaps one of the biggest reasons is because our brains are hard wired to respond to threats. When the stock market is “threatening” our money we think we have to DO SOMETHING!! Doing nothing seems CRAZY! How can we be PATIENT when our livelihoods are threatened?

The media makes this even worse. They know that when we feel scared we stay glued to our television so they do all that they can to stoke the fear. As fear grows, so do ratings, and so does our desire to “do something”. We start compulsively checking our investments, we abandon our long term view, and we drive our spouses crazy. 🙂

Selling out of the stock market might feel like a prudent action. If you follow your emotions and sell out, initially it might look like you’ve done the right thing. You watch the stock market continue to fall. You feel really wise in that moment.

But here’s the problem: in order for this sale to be a wise move, you have to be brave enough to buy back in at a point when the stock market is LOWER than when you sold. I have never met an investor who was scared enough to take their money out and yet brave enough to put it back in when the markets looked more bleak. If you “wait for things to calm down”, the market will likely be back up at a higher point than it was when you took your money out… and that means you’re worse off than you would have been if you would have just stayed put.

Patience Pay Off

If you invested $10,000 in the S&P 500 and left it fully invested for the last 15 years, you would have earned an average return of over 10% (data from 12/31/2007 through 12/31/2022).

HOWEVER, IF YOU MISSED ONLY THE 10 BEST DAYS IN THE MARKET YOUR RETURN DROPS IN HALF!

And guess when the best days in the market usually happen… you guessed it, right after the worst days.

Assuming you’ve made wise, diversified investments according to a reasonable risk tolerance, doing nothing in a downturn may be precisely the right thing to do.

Shut off the television and take a walk.

Stop compulsively looking at your statements.

A New Way of Thinking

Try to start thinking about your investments in the stock market more like you think of the investment you’ve made in your home. You bought it and you don’t worry month to month about how much someone is offering you for it.

Imagine if someone knocked on your door today and offered to buy your house for 1/2 of what you paid for it. You wouldn’t go in the living room and cry because you lost all of that money. You would just say “No thank you. You’re crazy. Have a nice day” and you would go on with your life.

Your monthly statements are like that person knocking on your door with an offer to buy your investments. They are a reflection of the price that investors would pay you for your portfolio if you sold it on your statement date. If you’re not selling today, just open your statement and say “No thank you. You’re crazy. Have a nice day” and go on with your life.

Benjamin Graham, one of the top investment guru’s of our time, says

“In the end, how your investments behave is much less important than how you behave.”

If you’re not sure if you’re properly diversified, if you can’t shake the question of whether or not your financial advisor is really working for you, then don’t play the waiting game. We would love to give you a second opinion. Give our office a call.